Bitcoin ETF Approval: SEC Gives Retail Investors Green Light

Get ready to mark your calendars for a key event in the cryptocurrency world: the 2024 Bitcoin halving. If you're invested in Bitcoin, considering it, or just curious about digital currencies, this event is significant. The halving not only impacts the miners who power the network but also has historical precedence for influencing Bitcoin's price and by extension, the broader crypto market. But what exactly is a Bitcoin halving, and why should you pay attention? Let’s dive in and get a clearer picture of this anticipated occurrence.

Understanding Bitcoin Halving

The SEC's nod signifies a pivotal moment for the crypto industry, ushering in opportunities for mainstream investors. A Bitcoin ETF could subject the crypto asset class to the highest level of regulatory scrutiny, enhancing market credibility.

What is Bitcoin Halving?

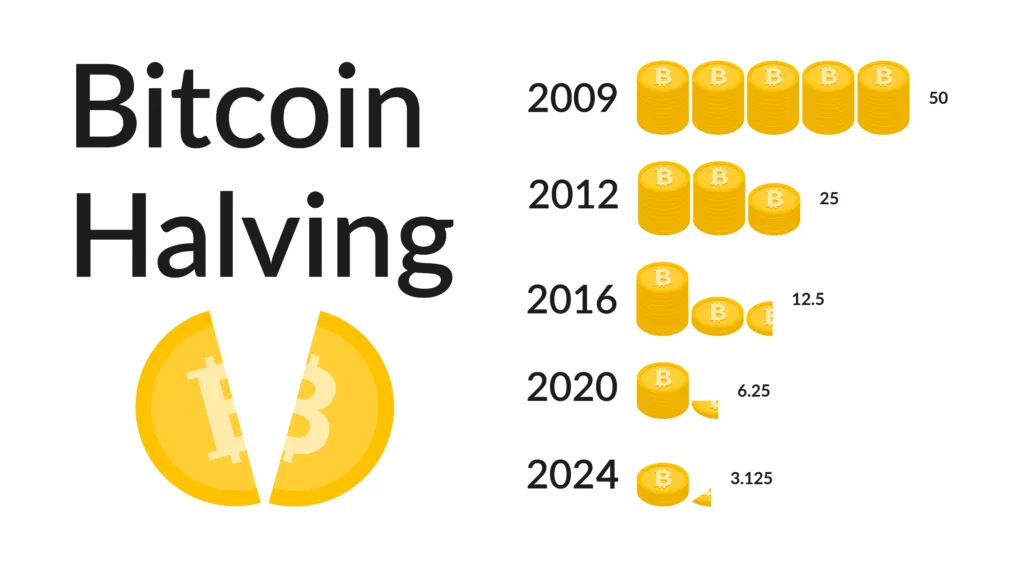

Bitcoin halving is an event that halves the rate at which new bitcoins are created, and it occurs roughly every four years. Fundamentally, this event reduces the reward for mining new blocks by 50%, thereby decreasing the supply of new bitcoins. This mechanism is encoded into Bitcoin's protocol by Satoshi Nakamoto, its mysterious creator, intended as a means to simulate the scarcity of precious resources. After a halving, successful miners receive 50% fewer bitcoins for verifying transactions. Bitcoin halvings continue until the maximum supply of 21 million bitcoins has been generated by the network, which is predicted to occur around the year 2140. This deflationary event is significant because it affects the number of new bitcoins being generated by the network, which in turn influences the bitcoin price.

Significance of Bitcoin Halving

The significance of Bitcoin halving can primarily be observed in its impact on the price. It can be attributed to the basic principles of supply and demand. If the supply of bitcoins decreases while the demand remains stable or increases, the price per bitcoin should rise. Moreover, halving is often viewed as an event that ensures Bitcoin's price stability over the long term, reducing inflation and increasing scarcity, which theoretically should make it more valuable. From an investment perspective, halvings have historically signaled the beginning of bullish trends in the market. This event is pivotal for investors as it greatly influences market sentiment and speculative activity surrounding Bitcoin.

Historical Data on Bitcoin Halving Events

Previous Halving Events

There have been three halving events in the history of Bitcoin. The first halving occurred in November 2012, when the mining reward decreased from 50 bitcoins to 25 bitcoins. The second halving happened in July 2016, reducing the reward further to 12.5 bitcoins. Most recently, in May 2020, the reward was halved again to 6.25 bitcoins. Each of these events was preceded by significant speculative activity and media attention, driving the interest of both seasoned and new investors.

Price Movements Pre and Post-Halving

Analyzing the price movements pre and post-halving provides interesting insights:

- The first halving in 2012 saw the price increase from about $12 to over $1,150 in the next year.

- Before the second halving in 2016, the price was around $650, and over the next 17 months, Bitcoin reached a then all-time high of nearly $20,000.

- Prior to the third halving in 2020, Bitcoin’s price hovered around $8,800; following the halving, amidst global economies grappling with pandemic-induced challenges, the cryptocurrency soared past $64,000 in April 2021.

These trends highlight a pattern where, historically, the Bitcoin price experienced significant growth following each halving event. Though past performance is not indicative of future results, these data points are closely analyzed by investors attempting to predict how future halvings could affect the Bitcoin market. Each event seems to have built an anticipation that can lead to substantial price surges, driven by heightened investor interest and a stark reduction in Bitcoin supply.

Impact of Bitcoin Halving on the Crypto Market

Effects on Supply and Demand

The principle behind Bitcoin halving is simple but its impact on supply and demand dynamics is profound. By design, Bitcoin undergoes a halving event approximately every four years, effectively reducing the reward that miners receive for validating transactions by half. This reduction in the flow of new bitcoins increases scarcity. Considering supply, this programmed scarcity tends to boost the price over time, assuming demand remains consistent or increases. However, the limited supply can also deter new investors who might find it difficult to enter the market, thereby affecting the demand negatively. Historically, the anticipation of increased value has often led to a surge in buying activity before and after the halving, although the effect can vary.

Market Sentiment and Speculation

Market sentiment plays a crucial role in the cryptocurrency environment, with Bitcoin halving events typically generating a mix of excitement and anxiety among investors. Speculation about how much Bitcoin's price will rise post-halving contributes significantly to this sentiment. Media coverage and community discussions often hype up the potential for large profits, driving more speculative investments. This environment can lead to heightened volatility in the months surrounding a halving event. For investors, staying informed and approaching the hype with a balanced view can be critical to making sound investment decisions during these speculative waves.

Influences on Altcoins

The effects of Bitcoin's halving are not confined to Bitcoin alone; they ripple across the entire cryptocurrency market. Altcoins, or alternatives to Bitcoin, often experience a dramatic shift in market dynamics around a Bitcoin halving event. Sometimes, investors might shift funds to altcoins to achieve potentially higher gains, leading to increased volatility and trading volumes in the altcoin markets. Moreover, if Bitcoin experiences a significant price increase post-halving, the overall market sentiment might turn exceedingly positive, benefiting the altcoin markets. Conversely, if the halving leads to an unstable Bitcoin price, it could instill fear in the broader market, negatively impacting altcoins.

Strategies for Investors Preparing for the 2024 Halving

Hodling vs. Trading

As the 2024 halving approaches, investors are faced with the classic crypto dilemma: "hodling" (holding onto investments long-term) versus trading "Hodlers"

Hodlers has become a popular term in the world of cryptocurrencies. It refers to individuals who hold onto their digital assets for the long term, rather than engaging in frequent trading. Hodlers believe in the potential of their chosen cryptocurrency and are confident that it will increase in value over time. By adopting a patient and steadfast approach, hodlers aim to maximize their investment gains.

If you're a firm believer in the long-term growth potential of Bitcoin, you're likely to endure the market's fluctuating highs and lows, expecting the prices to rise in the aftermath of a halving. Alternatively, if you're a trader, you'd aim to profit from these price fluctuations through strategic buying and selling. Every strategy comes with its own set of risks and benefits. Holding on to Bitcoin can protect investors from short-term market volatility, but it calls for patience and steadfast faith. On the other hand, while trading may offer quick profits, it could also lead to substantial losses, especially during volatile times such as halving.

Diversification of Portfolio

Diversification is a key strategy for mitigating risk, especially in a market as volatile as cryptocurrency. For investors looking forward to the 2024 Bitcoin halving, diversifying across different digital assets besides Bitcoin can spread risk and potentially increase returns. Investing in a mix of altcoins, stablecoins, and maybe even venturing into tokens representing different sectors like DeFi (Decentralized Finance) or NFTs (Non-Fungible Tokens) could protect against adverse movements in Bitcoin’s price post-halving.

Expert Opinions and Recommendations

For any investor, but especially for those new to cryptocurrency, consulting with financial experts who specialize in digital assets can provide deeper insights into the potential impacts of the halving. Experts often provide a balanced perspective, not only highlighting the possible upsides but also drawing attention to the risks involved. They might offer tailored advice, factoring in individual investment goals and risk tolerance. Furthermore, staying updated with reputable crypto analysts and influencers can also help investors stay ahead of market trends and better prepare their portfolios for the anticipated shifts due to the halving.

Potential Challenges and Risks Associated with Bitcoin Halving

Scalability Issues

Bitcoin halving is an event that reduces the reward for mining new blocks by half, which happens approximately every four years. As the reward decreases, the incentive for miners diminishes, potentially decreasing the number of miners. This reduction in miners can lead to less network security and slower transaction times as there might be fewer miners to verify transactions. This scenario highlights a key scalability issue: the capacity of the Bitcoin network to handle vast amounts of transactions, especially under a decreasing reward schema. With a potential decrease in mining activity, the remaining miners might face overwhelming transaction volumes, leading to increased transaction fees and slower confirmation times.

Regulatory Concerns

With each Bitcoin halving, the spotlight shines brighter on the cryptocurrency, drawing more scrutiny from regulators around the world. As the value of Bitcoin may potentially increase, it becomes a more significant part of discussions among financial regulators. Countries might introduce new regulations or enforce existing ones more strictly. For investors and participants in the Bitcoin market, this can mean sudden changes in compliance requirements or restrictions that could affect how Bitcoin is bought, sold, or stored. Moreover, these regulatory changes could introduce market volatility or impact the global acceptance of Bitcoin as a digital asset.

Security Risks

The reduction in mining rewards due to Bitcoin halving could lead not only to reduced hash rates—a measure of the computational power per second used by miners to mine and process transactions—but could also intensify security risks. Lower hash rates can make the Bitcoin network more vulnerable to attacks, such as the 51% attack, where an entity gains control of more than half of the total computing power and can influence the network's transaction history. This decreases the security and integrity of the blockchain, potentially undermining user confidence in Bitcoin as a secure digital asset.

Conclusion

As we look forward to the Bitcoin halving in 2024, it's clear that this event could significantly influence the landscape of cryptocurrency investing. By halving the rewards for mining new blocks, Bitcoin not only becomes scarcer, but it also might become more valuable. For investors, this represents a potential increase in price and a pivotal moment for portfolio adjustments. Understanding this cyclical event can help in making informed decisions, potentially leading to lucrative outcomes in the world of digital assets. Stay tuned to the crypto markets and prepare for a shift that has historically sparked waves across the financial landscape.

To learn more about Bitcoin & Cyprocurrencies click here to register for my next weekly class!

Wishing you all profitable trades and success in your endeavors.

See you tomorrow in my CyberGroup Live Trading room (Open Monday thru Friday from 7:45am - 4:30pm EST)

If you aren't already a member, you can sign up today at https://ctu.co/trial

Happy Trading,

Fausto Pugliese

Founder & CEO

Cyber Trading University