LEARN DAY TRADING FROM A PIONEER

WITH OVER 30 YEARS OF REAL TRADING EXPERIENCE

TRADE WITH US EVERY DAY IN

THE ORIGINAL LIVE TRADING ROOM FOR DAY TRADERS

LEARN PRICE ACTION & ORDER FLOW FROM

REAL AND HIGHLY EXPERIENCED TRADERS

LEARN DAY TRADING FROM A PIONEER

WITH OVER 30 YEARS OF REAL TRADING EXPERIENCE

TRADE WITH US EVERY DAY IN

THE ORIGINAL LIVE TRADING ROOM FOR DAY TRADERS

LEARN PRICE ACTION & ORDER FLOW FROM

REAL AND HIGHLY EXPERIENCED TRADERS

CyberGroup Trial Group Walkthrough with Fausto Pugliese

CyberGroup Trading Room: Your digital hub for real-time market analysis, collaborative trading discussions, and expert insights, fostering a dynamic environment for traders to thrive and learn in today's fast-paced financial landscape.

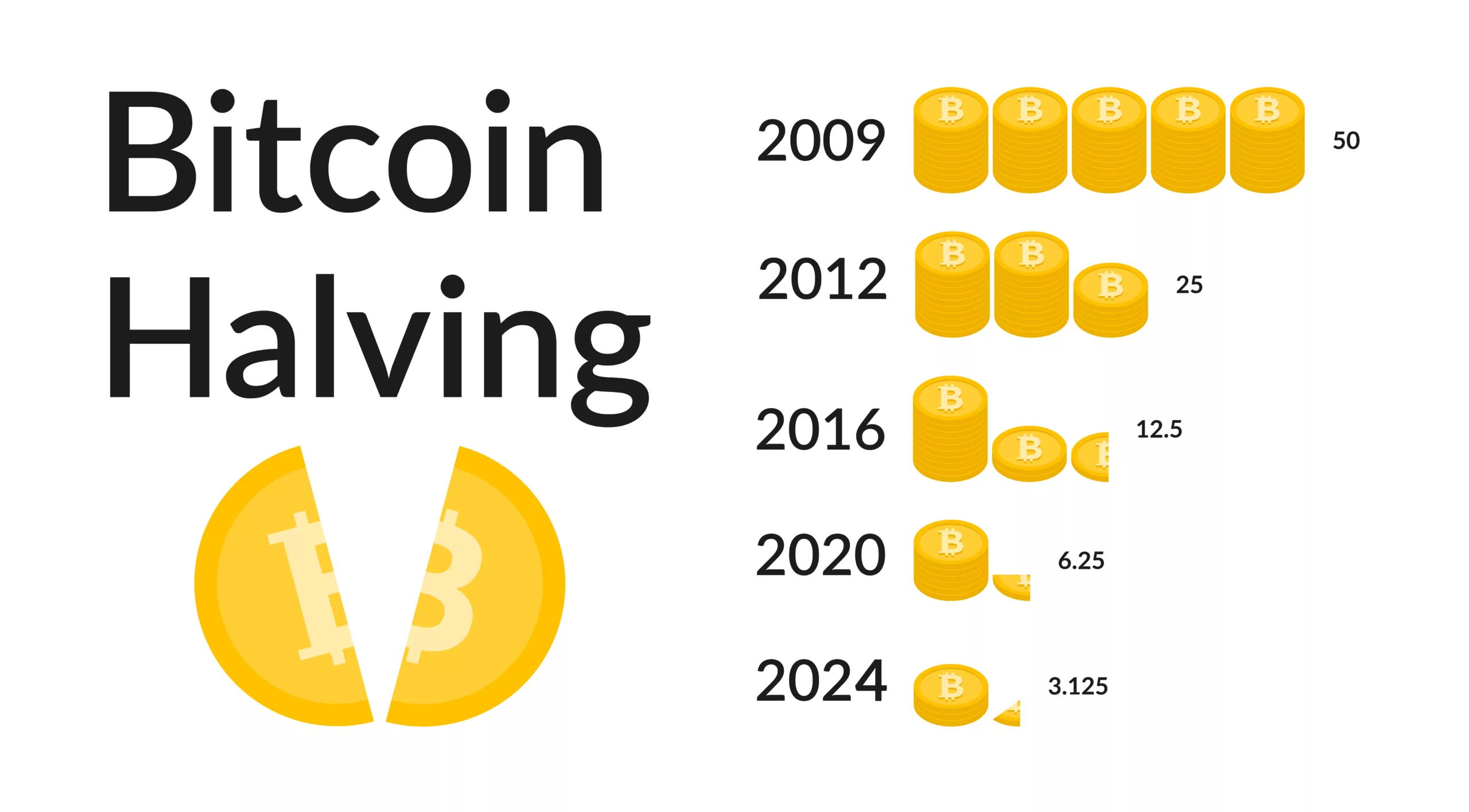

The Significance of Bitcoin Halving 2024

Curious about Bitcoin Halving 2024? Dive into the world of cryptocurrency, investment opportunities, and blockchain with our latest blog post! Learn all about the impact of this upcoming event on digital assets. 💰🔗 Check out the full details on our website now! #BitcoinHalving #Cryptocurrency #Investment #Blockchain #DigitalAssets #BlogPost

Traders Talk with Fausto Pugliese featuring Kathy Lien and Boris Schlossberg from BK Traders

In this exclusive session of "Traders Talk," join seasoned traders Kathy Lien and Boris Schlossberg from BKTraders as they delve into their daily approach to the market, uncovering new opportunities and essential tools. Discover how they navigate the ever-changing landscape of trading, and gain valuable insights into their strategies for success.

How to Trade Low Float Stocks: The Ultimate Guide

Master the art of trading low float stocks with our ultimate guide. Learn how to trade low float stocks like a pro on our blog.

Bitcoin ETF Approval: SEC Gives Greenlight to Retail Investors

Bitcoin ETF Approval: SEC Gives Retail Investors Green Light Exciting news for the cryptocurrency industry as the SEC gives retail investors access to a $BTC ETF.

Day Trading 101 Stock Trading Class with Fausto Pugliese | January 4th, 2024

Explore the world of trading with Fausto Pugliese in this insightful video! Join the seasoned expert as he shares valuable insights, strategies, and practical tips to navigate the financial markets successfully.

Since 1995, Cyber Trading University is one of the original online day trading schools.

We provide a full suite of programs to help you take control of your own financial future.

For ONLY $9 You'll Receive 1-Week of:

- Live Trading Chat Room (Open Mon-Fri)

- Pre-Market Movers Alerts

- Daily Meetings with Fausto & CTU Team

- Actionable Trading Ideas Throughout Each Day

- Morning & Afternoon Watchlists

- Real-Time Watchlist Alerts

- Traders Talk Q&A Workshop

- Workshop Library

- Fausto's E-Book

- Personal Education Advisor

4.9 85 reviews

-

APR BILLING ★★★★☆ 3 months ago

Cyber Trading University truly helped me improved my day trading skills, strategies and practical approach. I have been trading since 2013 and I must say I have not even realized how much I was missed. They provide great educational courses … More presented in a simplified manner. Well organized, explained and presented.

CTU Instructors are very supportive and helpful, truly care for students. Definitely created a good collaboration, and a well supportive team. They helped me build my new trading platform and added new supportive tools that allow me to improve my day trading.

I appreciate the support of the team immensely and want to say thank you!

Anna M. -

kosnmotion ★★★★★ 4 months ago

I've been with CTU a little over two years now. Fausto and his all star team make it fun to day trade but most of all, teach you how to make money. With their daily watchlists and education on what to look for is invaluable. I highly … More recommend you to try them out and see what it's all about. -

Keith Anderson ★★★★★ a month ago

Exceptional daily explanations of the stock market as it moves from minute to minute. For anyone wanting to make it as a day trader (or swing trader), connect with Cyber Trading University for in-depth education and support morning and … More afternoon. The CTU folks are dependable and dedicated to their students' success. -

Mark S ★★★★★ 5 months ago

My experience with Fausto, Josh, Rich, and John (my education advisor) has been critical in my trading journey. The entire team at CTU has provided me with a solid framework, including classes, workshops, and live market trading analysis, … More allowing me to interpret market activity for active day trading.

Since I joined CTU in 2018, I have continued to work on my trading skills, and the team at CTU supported me fully whenever I reached out to them. They always show up, stand behind their word and give all they have to help their student family become successful professional traders.

Thanks to CTU and their excellent tools and work ethic, I maintain my excitement to expand my trading knowledge. Keep up the superb work, Fausto and the entire CTU Team! -

Margaret Grotowski ★★★★★ 4 months ago

I am so happy I joined CTU I very nearly didn't. Fausto, Josh, Rich and all the CTU staff are the best. Great training courses on many levels and friendly live trading room experience make it an excellent choice. If you want to learn … More to trade as I did this is the place to be. -

David Carlier ★★★★★ 4 months ago

Cyber Trading University accelerated my learning curve and boosted my confidence in no time. I extend sincere gratitude to the entire Cyber Trading University team for their unwavering commitment to providing a top-notch trading education. … More For those serious about becoming successful traders, Cyber Trading University is undoubtedly the place to be. Thank you for an outstanding learning experience!

If you would like to get a glimpse of how Fausto teaches and learn about his methods of training...