Bitcoin Soars to $43K: What You Need to Know

Bitcoin's price performance has been nothing short of spectacular, with the cryptocurrency hitting a yearly high of $43,000 USD. This unprecedented rally in the last year has left many investors wondering about the future of Bitcoin and its impact on the market. In this post, we will dive deep into understanding Bitcoin, including its founding, technological aspects, economics, and social media presence. We will also explore Bitcoin's impact on other cryptocurrencies and its market stats, including the ever-changing USD price. Lastly, we will discuss what the future holds for Bitcoin and what the cryptocurrency market might look like in the years to come. Whether you're a seasoned investor or just starting out in the world of cryptocurrency, this post is a must-read for anyone interested in Bitcoin.

Bitcoin's Spectacular Price Performance

Bitcoin has captivated global markets with its remarkable price surge and record-breaking market cap. Its soaring value has significantly impacted investor sentiment, drawing attention from diverse sectors. The unprecedented bullish sentiment reflects the cryptocurrency's growing influence, setting new industry standards.

The Unprecedented Rally in the Last Year

In the past year, there has been a remarkable surge in Bitcoin's price, impacting the cryptocurrency market significantly. This exceptional rally has drawn close attention from investors and reflects sustained and unprecedented growth. The surge in Bitcoin's value has set new records, influencing market sentiment across various sectors.

Hitting the $43,000 Mark

Bitcoin's price has shattered expectations, breaking the $43,000 mark and causing ripples in the cryptocurrency market. This milestone demonstrates Bitcoin's growing impact and has sparked widespread discussions and analysis within the community. The cryptocurrency market's response to this achievement reflects the significant influence of Bitcoin's unprecedented rally.

Understanding Bitcoin

Bitcoin, introduced by the pseudonymous Satoshi Nakamoto, has reshaped global finance with its decentralized nature. Its emergence has revolutionized currency and finance concepts, intriguing experts and enthusiasts alike. Created through mining, Bitcoin's decentralized cryptocurrency has rewritten financial rules and gained global recognition, impacting everyday lives and reshaping traditional concepts.

The Founding of Bitcoin

Bitcoin's journey commenced with the mining of the genesis block, signifying its origin. A white paper, authored by Satoshi Nakamoto, laid Bitcoin's foundation and introduced new features. The first known Bitcoin transaction, involving programmer Laszlo Hanyecz, is part of its history. The release of open-source software by the lead developer Gavin Andresen propelled Bitcoin into the mainstream, influencing the cryptocurrency space. The first block, known as the genesis block, was mined by Nakamoto on January 3, 2009, marking the launch of the world's first cryptocurrency.

What Makes Bitcoin Unique

Bitcoin's groundbreaking blockchain innovation has revolutionized transparency and security. Unique features like the network alert key and its status as a peer-to-peer online currency differentiate it from traditional currencies. As the first electronic currency, Bitcoin holds monumental significance. Its decentralized nature fosters trust and autonomy among users, while its smaller units, known as Satoshi's, embody a distinct value proposition for the central bank. Additionally, Bitcoin's ability to send bitcoins to several recipients in a single transaction, as well as its hard fork that resulted in Ethereum Classic, sets it apart from traditional currencies. With the ability to buy and sell Bitcoin on the most secure crypto exchange, Coinbase, it's clear that Bitcoin is leading the way in the world of cryptocurrency.

Bitcoin as a Store of Value

Bitcoin's appeal as a store of value has drawn both institutional and retail investors, positioning it as a hedge against inflation. This digital gold concept has influenced long-term investment strategies due to Bitcoin's resilience and price performance, solidifying its status as a reliable store of value.

Bitcoin's Technological Aspects

The transformation of data management and security by the blockchain, vital for Bitcoin's operations. Bitcoin mining's role in securing and validating transactions cannot be overstated. Decentralization is ensured by independent network participants, making the bitcoin network secure and efficient. Scrutiny on transaction fees and carbon footprint. The robust technological framework benefits from Bitcoin's global community and network alert key.

The Role of Blockchain in Bitcoin

The structure of the blockchain ensures the integrity and immutability of Bitcoin transactions, while its consensus mechanism involves network participants in validating and recording transactions. The genesis block symbolizes Bitcoin's beginning and the blockchain extends its impact beyond finance, influencing various industries.

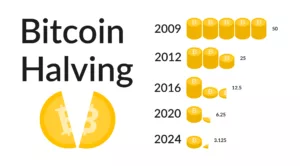

Understanding Bitcoin Mining

The validation and addition of transactions to the blockchain form the basis of Bitcoin mining. Miners are essential in facilitating the mining of new blocks, maintaining the network's sustainability. The issuance of new bitcoins and mining difficulty drive the ecosystem, while energy consumption remains a topic of debate.

Challenges in Decentralization and Scalability

Achieving global scalability while preserving decentralization presents a complex challenge for Bitcoin. The ongoing struggle to balance network updates with the decentralized nature of the cryptocurrency highlights the difficulties. Additionally, the need to meet the demands of a global transaction network further emphasizes the challenges faced in maintaining decentralization and scalability.

The Economics of Bitcoin

Based on principles of scarcity and decentralized value, Bitcoin's economic model aims to reduce centralized control and inflation. Its limited supply and decentralized nature contribute to its store of value properties. Factors such as mining rewards, transaction fees, and global financial impact further shape the economics of this decentralized cryptocurrency.

Recognition as a Currency

Bitcoin's evolving status as a currency, with the support of public figures like Elon Musk and Vitalik Buterin, impacts its global adoption and regulatory scrutiny, presenting legal and regulatory challenges for governments. Addressing its role in everyday transactions and store of value is crucial in recognizing Bitcoin as a currency and addressing concerns about potential money laundering. Legal status influences its integration into mainstream finance, requiring careful consideration of its impact.

Use for Payments and Investment

The evolving value proposition of a decentralized cryptocurrency like Bitcoin plays a crucial role in its dual function as a medium of exchange and an investment asset. Balancing its use for payments and investment involves addressing transaction speed, fees, market volatility, and regulatory developments as it integrates into traditional finance systems. This impacts its adoption and market dynamics.

The Impact of Bitcoin on the Market

Bitcoin’s impact on the market goes beyond price movements, challenging traditional financial systems. It influences investment strategies, asset allocation, and global finance discussions. Bitcoin also affects market sentiment, risk management, and interacts with traditional asset classes. Understanding its market impact requires comprehensive analysis.

Bitcoin's Influence on Other Cryptocurrencies

The inception of the first cryptocurrency underpins its influence on others. Market dominance and network effects reinforce its impact, shaping discussions on trends and innovation. This relationship extends to market dynamics and investor behavior, significantly impacting the broader crypto ecosystem.

Bitcoin's Market Stats

Bitcoin's market data unveils insights into adoption, trading volume, and market capitalization, reflecting its role as a leading cryptocurrency and global financial asset. Monitoring these stats is crucial for understanding its impact on the broader market, influencing investment decisions and market analysis within the cryptocurrency space.

Bitcoin's Social Media Presence

Bitcoin's influence on social media reflects a diverse global community. Discussions encompass price analysis, trends, and regulations, shaping public perception and market sentiment. Tracking its mentions, sentiment, and engagement is crucial to understanding its impact. Bitcoin's presence demonstrates its significance in online conversations and global awareness.

Highlights from Twitter and Reddit

Engaging with discussions and analysis, monitoring Twitter and Reddit for insights allows involvement and learning. Bitcoin's impact on social media reflects its significance and market trends, contributing to the global narrative. The presence of Bitcoin on Twitter and Reddit offers diverse perspectives and community sentiment, shaping the discourse and understanding.

Advanced Trading Pairs in the Market

The evolving cryptocurrency landscape is reflected in advanced trading pairs involving decentralized cryptocurrencies like Bitcoin. These pairs offer insights into market liquidity and trading strategies, demonstrating Bitcoin's integration into sophisticated market instruments. Understanding advanced trading pairs enhances the analysis of Bitcoin's market dynamics and its role in global cryptocurrency trading.

The Future of Bitcoin

The growing acceptance of Bitcoin, including by top investors such as Warren Buffett, suggests a potential ongoing surge in its value. Regulatory scrutiny and institutional adoption, including the research and data provided by the University of Cambridge, may shape its future. The global community's embrace of Bitcoin as a store of value could be transformative. Technological advancements, such as those discussed on Yahoo Finance, may improve transaction speeds and lower fees. Addressing the environmental impact of mining and reducing greenhouse gas emissions is crucial for the worth of bitcoin and sustainable development.

What Will the Bitcoin Market Look Like in the Future?

The future of the Bitcoin market holds the potential for increased integration with traditional financial systems, heightened volatility, and market capitalization. Innovations in blockchain technology and the adoption of Bitcoin as legal tender by countries like El Salvador may shape its trajectory. Exploration of smaller units and transaction fees is also expected.

How does the value of Bitcoin fluctuate in the market?

The value of Bitcoin fluctuates in the market due to various factors such as supply and demand, investor sentiment, market trends, regulatory developments, and macroeconomic conditions. It is a highly volatile asset, and its price can change rapidly based on these factors.

Conclusion

In conclusion, Bitcoin's rally has been nothing short of remarkable. With its price soaring to an impressive $43,000, it has captured the attention of both investors and the general public. Understanding the fundamentals of Bitcoin is crucial in realizing its potential as a store of value and its unique attributes. The technological aspects, such as blockchain and mining, play a significant role in its success. Additionally, Bitcoin's impact on the market cannot be overlooked, as it has influenced other cryptocurrencies and has seen widespread recognition as a currency. As we look to the future, it is uncertain what the Bitcoin market will look like, but one thing is for sure – the enthusiasm surrounding Bitcoin is here to stay.

To learn more about Bitcoin & Cyprocurrencies click here to register for my next weekly class!

Wishing you all profitable trades and success in your endeavors.

See you tomorrow in my CyberGroup Live Trading room (Open Monday thru Friday from 7:45am - 4:30pm EST)

If you aren't already a member, you can sign up today at https://ctu.co/trial

Happy Trading,

Fausto Pugliese

Founder & CEO

Cyber Trading University