What is Nasdaq Totalview and how does it work?

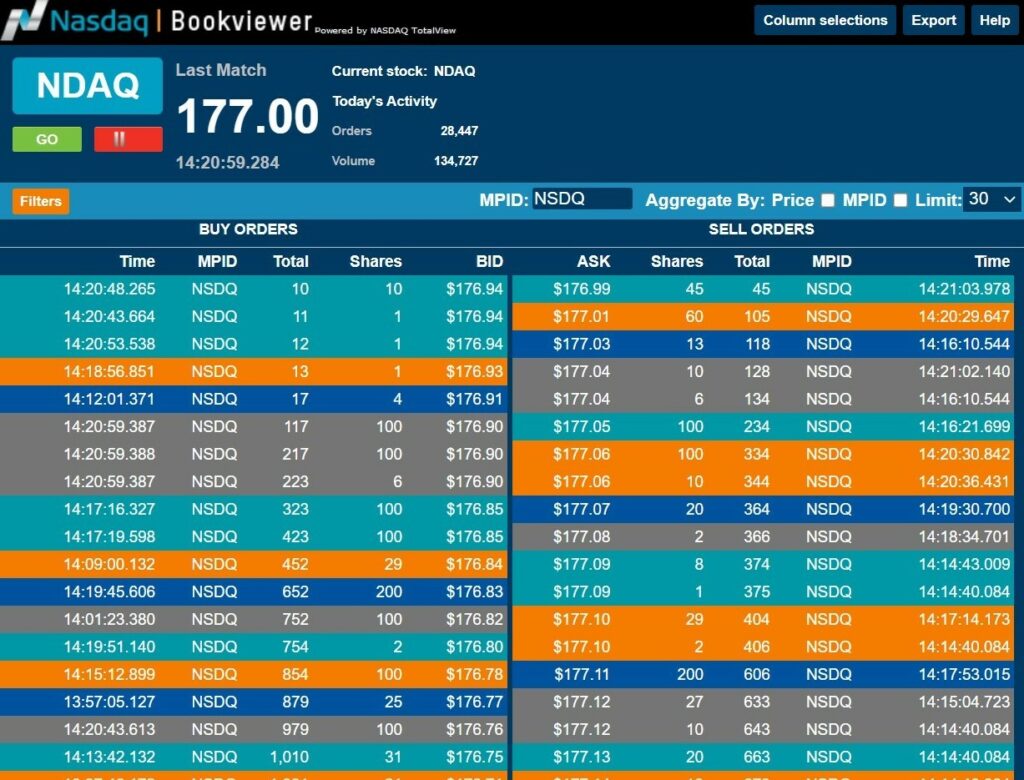

Nasdaq Totalview is a tool that provides traders with real-time access to the complete book of orders on the Nasdaq exchange. It displays all bid and ask prices, sizes, and the market participants behind them. This allows traders to make more informed decisions based on the depth and liquidity of the market.

For traders, staying ahead of the game is crucial. NASDAQ TotalView is a tool that provides traders with real-time access to all Nasdaq markets’ depth-of-book data. This means that traders can see the complete picture of all buy and sell orders for any stock on NASDAQ at any given time. In this blog, we will explore what NASDAQ TotalView is and why it's significant in trading. We will delve into its key features, potential benefits, and competitive advantages. We will also provide tips on how to get the most out of NASDAQ TotalView to optimize your trading strategy. If you're a trader looking for an edge in the market, read on to learn everything you need to know about NASDAQ TotalView.

Exploring NASDAQ Totalview

Gain access to the complete order book depth and uncover hidden trading opportunities with NASDAQ Totalview. Explore the pockets of liquidity within its market data, revealing price levels that standard data feeds may not display. Experience the unique advantages offered by NASDAQ Totalview for market participants. Discover the true market depth and enhance your trading strategies with three times the liquidity within five cents of the inside market.

The Significance of NASDAQ TotalView in Trading

NASDAQ TotalView provides a comprehensive view of market participants, order imbalance, and trading opportunities. Traders can access the lowest bid and ask prices, as well as the total size of displayed quotes. The net order imbalance indicator helps identify potential trades, while the opening and closing crosses offer additional trading benefits. Utilizing this unique order imbalance data can lead to informed trading decisions and accurately gauging the true buy and sell interest in securities.

A Brief Overview of NASDAQ TotalView

NASDAQ Totalview provides the full depth of orders, including buy and sell orders, for the NASDAQ stock market. It offers market participants access to the complete list of companies trading on the NASDAQ stock market. Used by institutional investors, individual investors, and trading firms, NASDAQ Bookviewer provides detailed financial information, display devices, and direct data feed products, including the standard NASDAQ data feed. It is the premier market data product for accessing exchange data.

Delving into the Features of NASDAQ Totalview

The core of NASDAQ Totalview is its depth-of-book feature, providing complete market depth information through the use of TotalView depth data. Traders can access it through various options such as web products and direct data feed. NASDAQ Data Link delivers the full depth of NASDAQ Totalview orders. Detailed technical documentation is available for trading firms and market data distributors. Explore the complete list of market participants, liquidity of level 2, and order book depth with NASDAQ Totalview.

Depth-of-Book: The Core Feature

Depth-of-book is the heart of NASDAQ Totalview, providing the complete depth of orders. Explore bid price, ask price, and total size of quotes displayed. Gain access to order book depth, market participants, price levels, and liquidity. Analyze trends, liquidity, and order imbalance using depth-of-book data.

Access Options Available for Traders

Explore the suite of cloud APIs and specifications page on the NASDAQ trader website to access the full depth of orders, market data, and liquidity information. Choose from web-based products, direct data feed, or market data distributors that best suit your trading needs. Gain comprehensive market data from NASDAQ Totalview.

The Role of NASDAQ Data Link

NASDAQ Data Link delivers the full depth of orders within NASDAQ TotalView, providing access to market data and trading opportunities. It offers direct access to buy and sell orders, market participants, and order book depth through direct Nasdaq data feed products. Trading firms, market data vendors, and distributors benefit from NASDAQ Data Link's comprehensive data feed product.

The Potential Benefits of NASDAQ Totalview

Gain a competitive edge with NASDAQ Totalview's complete depth-of-book information. Access the largest US market single liquidity pool and unlock unique trading opportunities. Enhance trading strategies with full order depth, order imbalance data, and market depth information. Make informed decisions and capitalize on new opportunities.

The Edge in Day Trading: Complete Depth-of-Book

Day traders can gain an edge by utilizing the complete depth-of-book information provided by NASDAQ Bookviewer. This allows them to identify market trends, liquidity, and order imbalance, making data-driven trading decisions. Accessing the full order book depth, bid price, ask price, and total size of all displayed quotes is crucial for day trading success. The net order imbalance indicator helps in identifying trading opportunities and market imbalances. Stay ahead of the market with NASDAQ Totalview's complete depth of orders, market data, and liquidity information.

How NASDAQ TotalView Provides the Largest Single Liquidity Pool in the US

NASDAQ TotalView aggregates liquidity from various trading venues, creating the largest single liquidity pool in the US market. Gain access to the full depth of orders, market participants, and unique trading opportunities within the liquidity pool of NASDAQ TotalView.

The Competitive Advantage with NASDAQ Totalview

Gain a competitive advantage with NASDAQ Totalview, offering full order book depth for unique trading opportunities. Access pockets of liquidity to analyze market data and make informed trading decisions with complete market depth information. Identify price levels and market participants to develop better trading strategies and discover new trading opportunities.

How to Get the Most Out of NASDAQ Totalview?

To maximize your experience with NASDAQ Totalview, make use of the Nasdaq workstation product for comprehensive market data analysis. Explore the Nasdaq order book data feed products to meet the needs of the next generation of creators. Leverage the full depth of orders for valuable trading insights and liquidity information. Access a complete list of liquidity from level II data feed trading venues. Optimize your trading decisions by analyzing the best bid, ask price, and total size of all displayed quotes.

Can beginners use Nasdaq BookViewer, or is it more suited for experienced traders?

The Nasdaq BookViewer can be used by both beginners and experienced traders. It is a tool that provides real-time data on the order book for stocks listed on the Nasdaq exchange, including information about bid and ask prices, current orders, and market depth. While it may take some time for beginners to fully understand and utilize all the features of the Nasdaq BookViewer, including Nasdaq Basic, it can still be a valuable tool for learning about market dynamics and gaining insights into stock trading. Regardless of your level of experience, it is always a good idea to familiarize yourself with the functionality and features of any trading tool before using it extensively.

How user-friendly is the interface of Nasdaq BookViewer, and is it easy to navigate?

The interface of Nasdaq BookViewer is highly user-friendly and easy to navigate. It provides a clear and intuitive layout, making it simple for traders to access the book data they need. With its user-friendly design, even beginners can easily navigate the platform and make informed trading decisions.

Conclusion

To conclude, NASDAQ Totalview is a powerful tool that provides traders with a comprehensive view of the market. With features like depth-of-book and access to real-time data, it offers a competitive advantage to those who utilize it effectively. Traders can gain insights into the largest liquidity pool in the US and follow auctions to make informed decisions. To get the most out of NASDAQ Bookviewer, it is important to understand its features and what to look for when using it. Whether you are a day trader or an experienced trader, NASDAQ Totalview can help enhance your trading strategy and improve your chances of success in the market.

Wishing you all profitable trades and success in your endeavors.

See you tomorrow in my CyberGroup Live Trading room (Open Monday thru Friday from 7:45am - 4:30pm EST)

If you aren't already a member, you can sign up today at https://ctu.co/trial

Happy Trading,

Fausto Pugliese

Founder & CEO

Cyber Trading University